-

720 Main Street

Kansas City, MO 64105

-

720 Main Street

Kansas City, MO 64105

We Offer Creative Financing Solutions for Real Estate Investors

For Real Estate Investors interested in applying for a Worcester Financial Loan, please visit the Worcester Financial site at https://worcesterfinancial.com/

JOEL WORCESTER

Cofounder, Partner

JESSE WORCESTER

Cofounder, Partner

SARAH BARRETT

Director of Private Lending

MEAGAN BROWN

Portfolio Manager

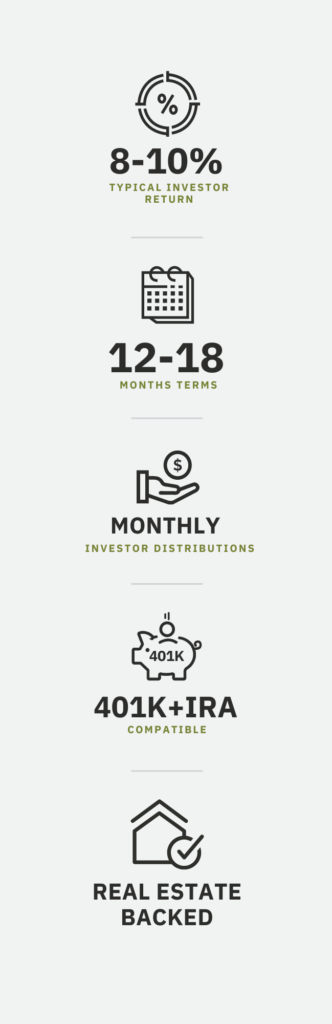

Worcester Financial is an asset based, hard money lender offering our investors an

average return of 9% on their investment. Our loans are short term and generally do

not exceed 18 months. The loan is collateralized by real estate or a physical asset.

We generally lend up to 70% of the after renovated value of the collateral. Our team

underwrites the opportunities in-house and evaluates the risk based on borrower

history and market conditions. Upon approval from our underwriting group, we send the

opportunity to investors, allowing them to participate as a co-lender.

Worcester Financial acts as the Servicing Agent for all of our loans and ensures that

monthly payments are received from the borrower and sent directly to the investor’s

account. In the event of a default, Worcester Financial will manage the foreclosure and

collection of any losses on behalf of the Investor.

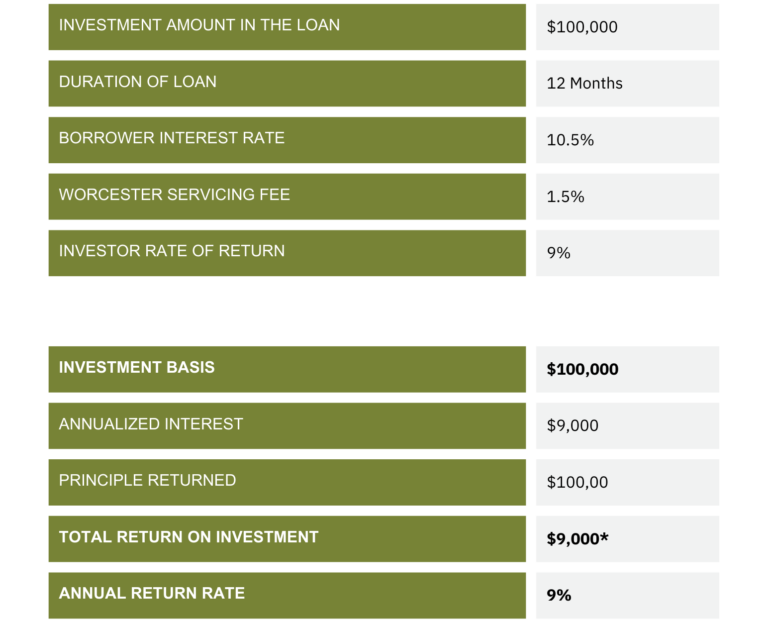

Worcester Financial is compensated by a combination of origination fees paid by the

borrower at closing as well as a monthly servicing fee. The monthly servicing fee helps

cover the cost of managing the loan portfolio and administrative expenses. The servicing

fee generally does not exceed 2% annually. For example, if the borrower is charged an

annual percentage rate of 11%, 9.5% is paid to the investor group and 1.5% is retained by

Worcester Financial as a servicing fee. Loan Servicing and management is a benefit to the

Investor but is always paid by the borrower.

We started Worcester Financial in 2016 after consulting with a lifelong investor and friend who successfully operated a private lending company.

He pointed out that our existing business model had about 80% of the infrastructure needed to run a successful private lending business. We already had an acquisition team and a growing property management company. Unlike traditional financing, we had all the tools needed to retain an asset and recover losses in the event of a default.

From the beginning, our philosophy has been to only lend on assets that we are comfortable owning. We have extensive experience within the Real Estate and lending industry and when faced with the worst case scenario, our team is equipped with the resources to not only take back the asset but also have the ability to complete the project and sell it.

Private lending is an excellent option for someone looking for passive income they can rely on monthly. Like any investment, there is still risk associated with these types of loans. If the borrower cannot repay the loan, we foreclose on the collateral and liquidate it.

Generally speaking, we have three different types of loans:

A bridge loan is typically used

when a borrower needs to secure

financing quickly. Bridge loans are

short term options for borrowers

who need time to obtain traditional

financing or sell an asset.

This is our most common loan

product. A borrower purchases

an asset at under market value,

makes improvements and sells

the rehabbed property for a profit.

BRRR is an acronym for Buy, Rehab,

Rent, Refinance. BRRR loans are

for well qualified borrowers who

plan to hold the real estate after

renovation. We finance the asset

as well as the rehab and then the

borrower refinances the property

through traditional financing once it

is rented and stabilized.

*Annualized interest calculated using a 30/360 basis. Interest earned may differ slightly